Page of

Page/

- Reference

- Intro

Unlike concentration camp prisoners and prisoners of war, civilian forced laborers were paid a wage for their work. However, they did not all receive the same amount: While northern and western European civilian laborers in particular were paid the same wages as German workers, the wages paid to Polish and Soviet civilian laborers were significantly lower for a long time.

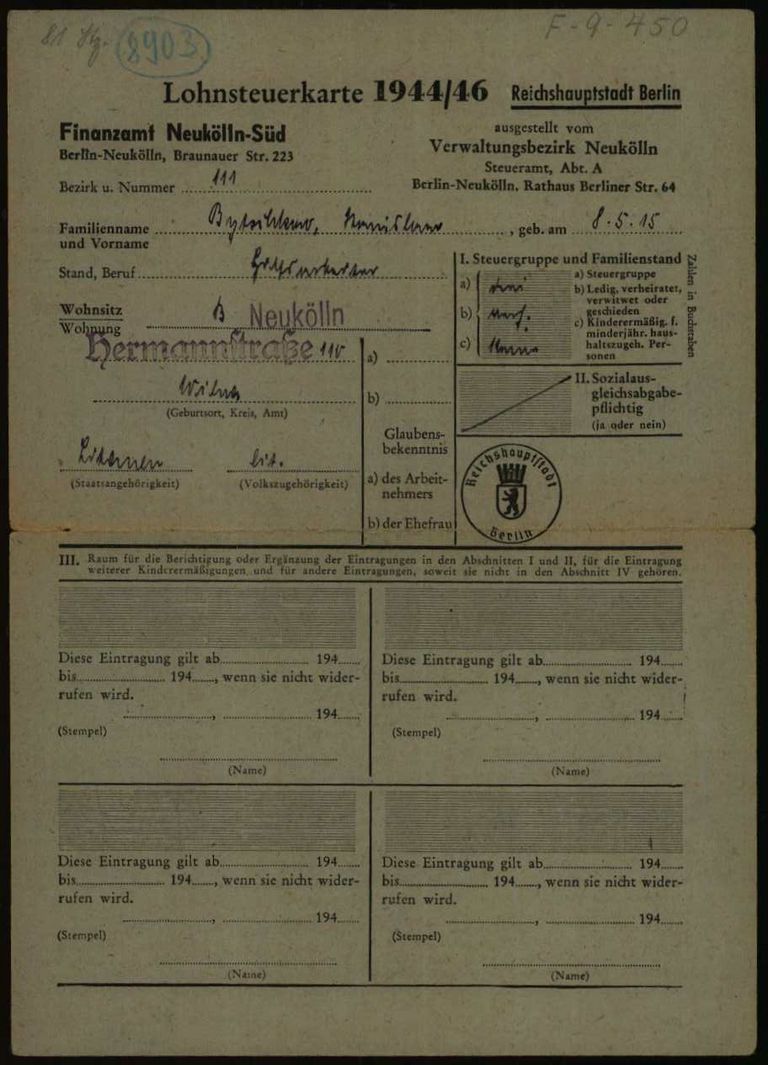

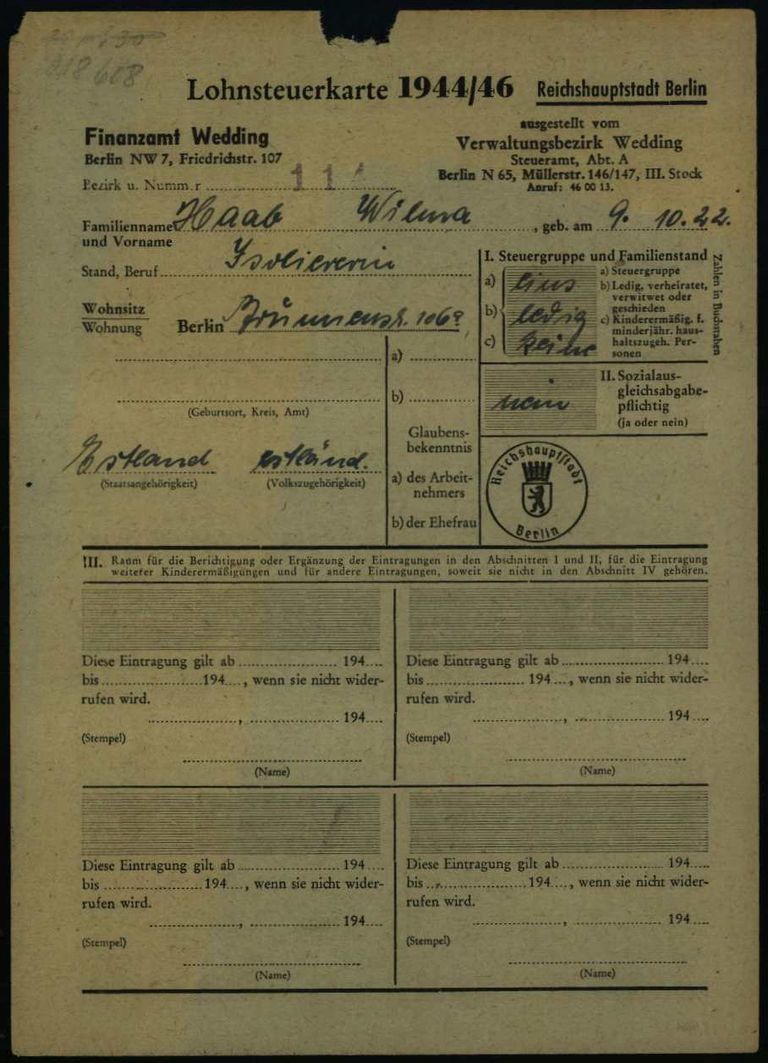

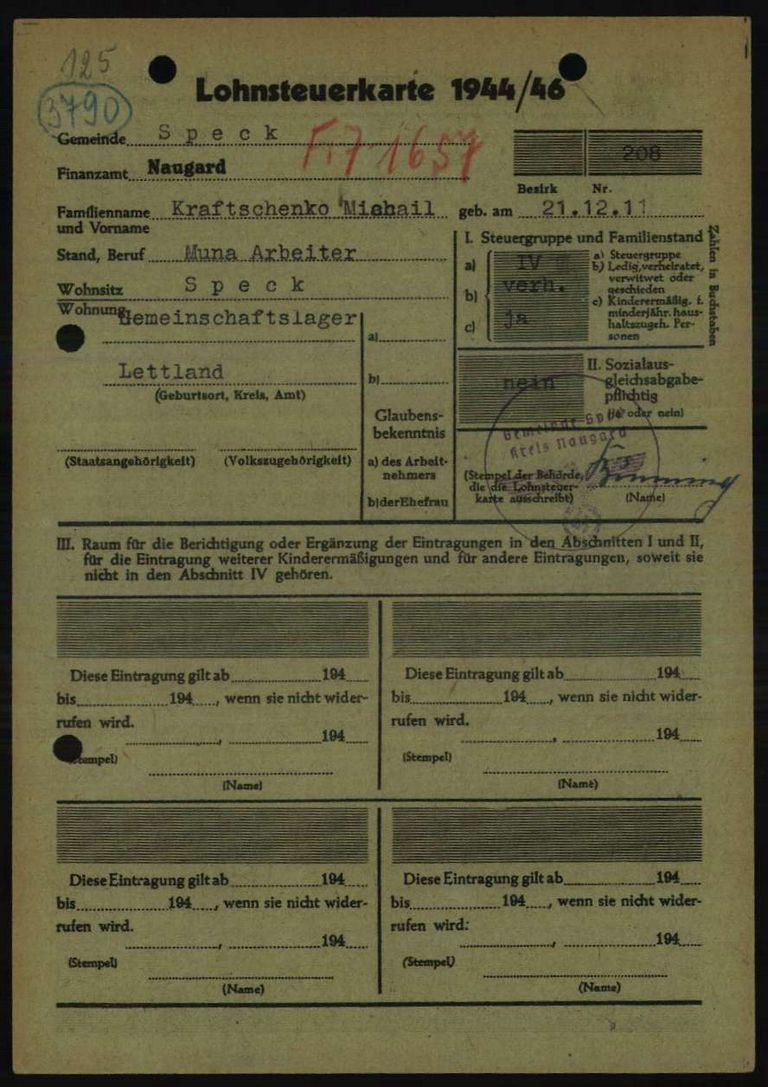

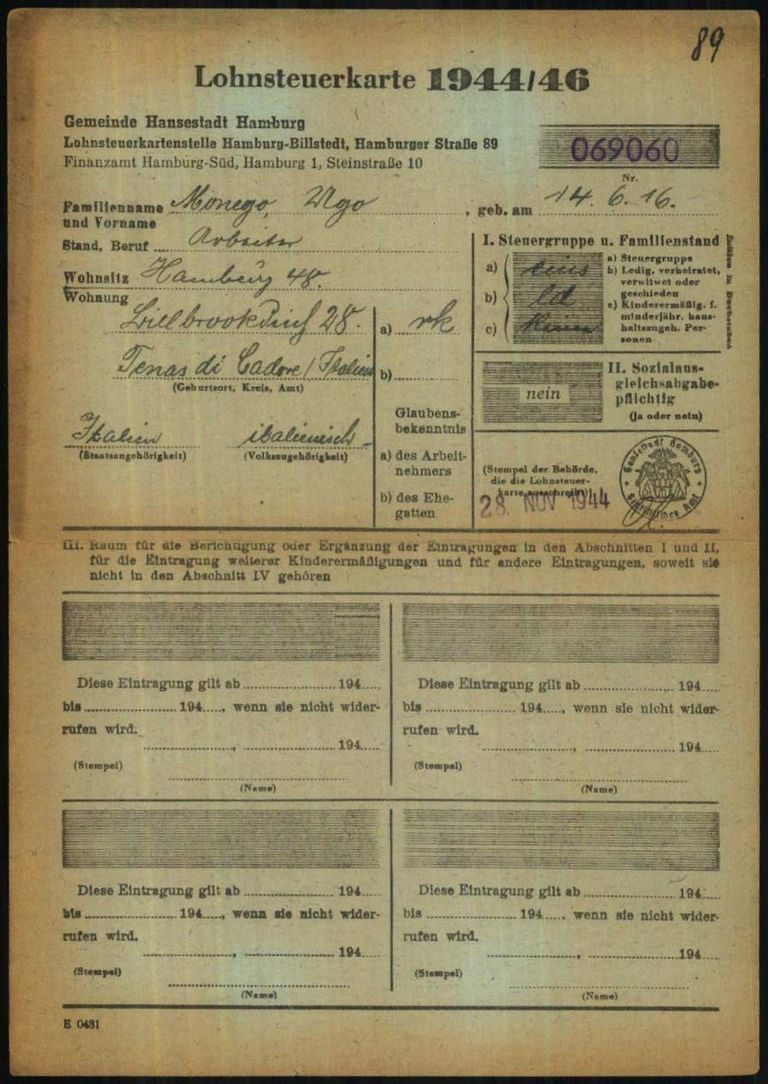

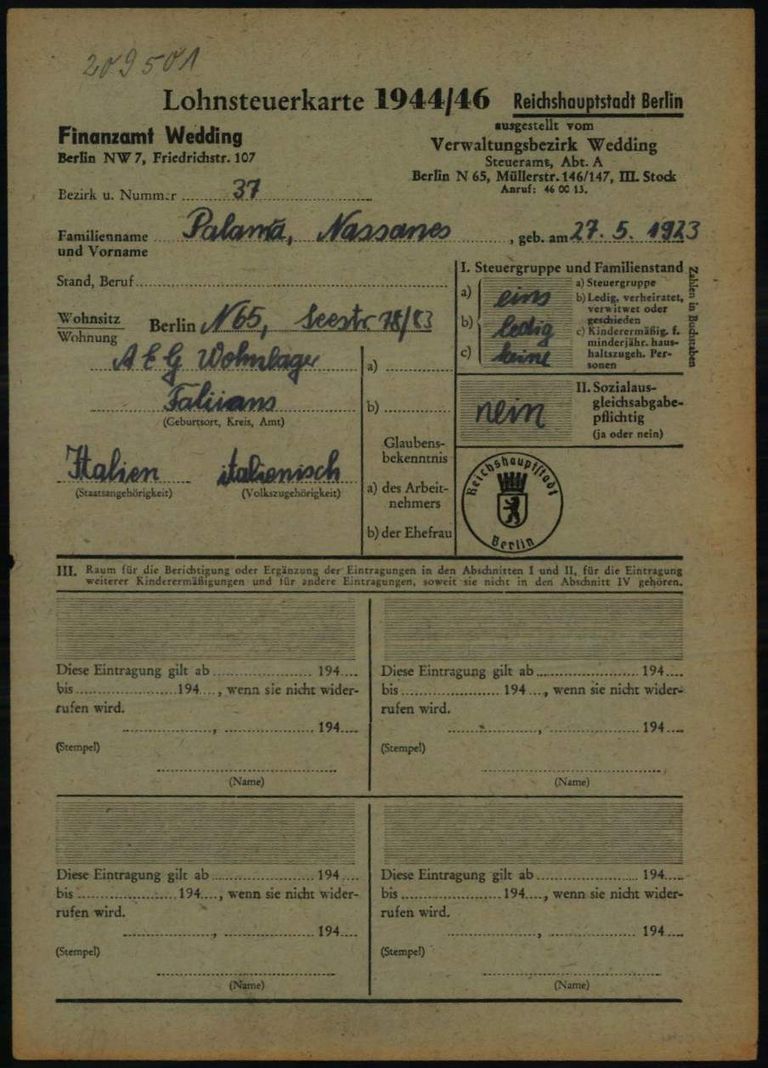

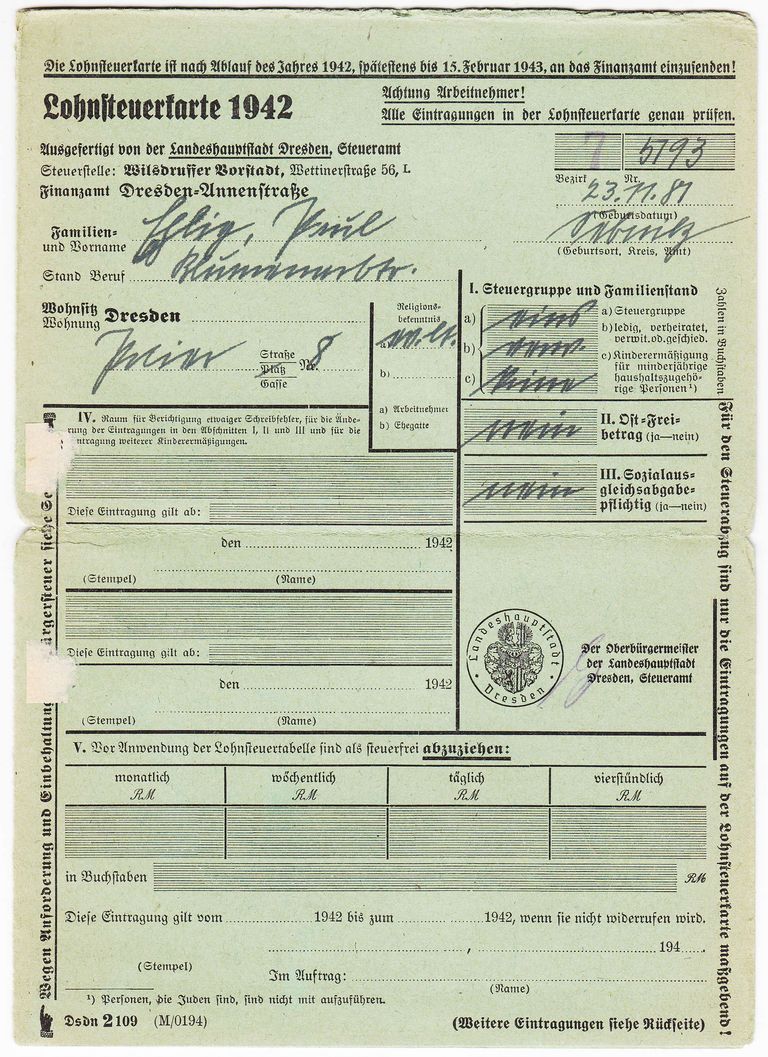

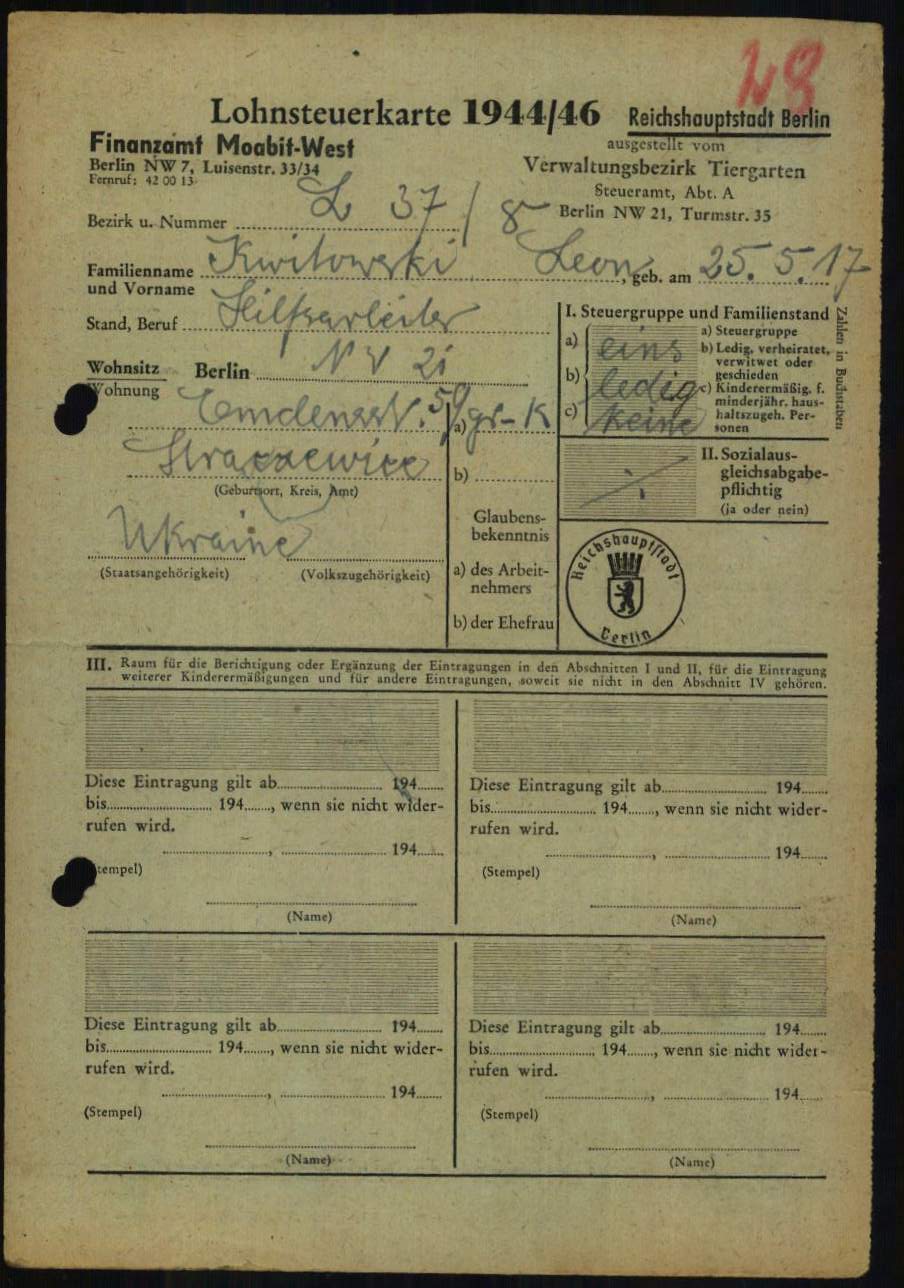

With a few exceptions, such as married Slovakians whose spouses did not live in the German Reich, for example, all civilian forced laborers were required to pay tax on their wages. Initially, only Soviet civilian laborers were exempt. Later, however, deductions were made from their wages for tax purposes too. Income tax cards (Lohnsteuerkarten) were used to calculate the income tax. These cards could differ slightly in terms of their appearance depending on where they were issued.

Unlike concentration camp prisoners and prisoners of war, civilian forced laborers were paid a wage for their work. However, they did not all receive the same amount: While northern and western European civilian laborers in particular were paid the same wages as German workers, the wages paid to Polish and Soviet civilian laborers were significantly lower for a long time.

With a few exceptions, such as married Slovakians whose spouses did not live in the German Reich, for example, all civilian forced laborers were required to pay tax on their wages. Initially, only Soviet civilian laborers were exempt. Later, however, deductions were made from their wages for tax purposes too. Income tax cards (Lohnsteuerkarten) were used to calculate the income tax. These cards could differ slightly in terms of their appearance depending on where they were issued.

Questions and answers

-

Where was the document used and who created it?

Staff at the relevant local tax office (Steueramt) issued income tax cards for all employees working in their district. Foreign civilian laborers also received such cards. The cards were given to the companies, as employees in the personnel or finance departments needed the information in order to calculate tax payments and wages. Income tax cards had to be returned to the relevant regional tax authorities at the end of a period of one year in most cases. Income tax cards are another example of the same procedure and the same documents being used for civilian forced laborers as for German workers.

- When was the document used?

Income tax cards were typical forms for all employees working in the German Reich. Almost all civilian forced laborers were subject to tax on their wages for the entire period. Only Soviet civilian laborers were exempt until 1944. There was also a special rule for married Danes, Slovaks, Hungarians, and civilian laborers from the Protectorate of Bohemia and Moravia. They were required to pay income tax in their native countries if their spouses lived there.

- What was the document used for?

The wages paid to civilian forced laborers and how much tax was deducted from their wages changed again and again throughout the course of the Second World War. The amount of wages they were paid and the amount of tax deducted depended mainly on where the civilian forced laborers came from or what their nationality was.

The German government passed laws that German and foreign laborers had to be paid equally. In other words, “foreign laborers could not be recruited and employed under more favorable wage and working conditions than comparable German workers” (Handbuch für die Dienststellen des Generalbevollmächtigten für den Arbeitseinsatz und die interessierten Reichsstellen im Großdeutschen Reich und in den besetzten Gebieten, Berlin 1944, Vol. 1, p. 117). What sounded fair on paper was not fair in reality. Initially, this rule only applied to western European civilian laborers. The vast majority of Polish and, most notably, Soviet civilian laborers generally received a lower wage in the early years of the war, from which contributions and extra taxes were then deducted. For a long time, they were deliberately excluded from special payments for working on a Sunday or family allowances. Polish and civilian laborers were also charged up to 1.50 Reichsmarks per day for board and lodging in the communal accommodation. In the end, they actually received only a small amount of their already low wages, and the rest was withheld. The regulations kept changing, and by the end of the war, Soviet civilian laborers also received more wages. Nevertheless, their financial situation remained difficult.

The obligation to pay social insurance and to pay income tax applied to almost all foreign civilian laborers in the same way as it did to German workers. Companies that employed civilian forced laborers therefore had to deduct a fixed amount from their wages and pay this to the relevant regional tax authority. How much income tax was due was determined by the income tax cards issued by the local tax offices. They indicated the person’s tax bracket (Steuergruppe). German employees received an income tax card from the issuing local tax office and handed it to their employer. If they ended their employment there before the end of a year, they received the card back so they could give it to their new employer. Unfortunately, it is still unclear whether civilian forced laborers received income tax cards in person from the issuing local tax offices, or whether these were sent directly to companies. It is also not yet known whether companies sent cards to each other if the employment offices deployed civilian forced laborers to another place of work. What is certain, however, is that the cards remained with companies for the specified period, usually a year, and were then sent to the regional tax authorities.

After the end of the Second World War, income tax cards were also important for clarifying the fates of civilian forced laborers. On orders from the Allies, administrative offices and companies were required to hand over documents relating to foreign civilian laborers such as income tax cards.

- How common is the document?

Nearly all forced laborers received at least one income tax card. As this card was only valid for a certain period of time, usually a year, there were several cards for civilian forced laborers who were required to perform forced labor over a longer period. Income tax cards had to be returned to the regional tax authorities within a certain period. Only the current cards were therefore held in the companies. At the end of the war, these remained in the companies, were destroyed, or in some cases ended up in archives.

Only a few income tax cards are held in the Arolsen Archives. As the cards were not filed in a separate card file, but filed alphabetically in the War Time Card File (Collection 2.2.2.1), which contains 4.2 million documents, it is impossible to say how many income tax cards have been preserved in the Arolsen Archives. But in the near future, modern computer technology will find the answer: clustering techniques will make it possible to identify income tax cards, as well as other documents, and to virtually collate cards of the same type. However, by no means have the income tax cards of all civilian forced laborers survived.

- What should be considered when working with the document?

There is only minimal information on the income tax cards, and in most cases, it is impossible to identify the company in which the person was required to perform forced labor. More information can be gleaned from the payroll index cards (Lohnstammkarten), which specify the start and leaving dates, and which also indicate which company kept them. Income tax cards do not include this information.

If you have any additional information about this document, please send your feedback to eguide@arolsen-archives.org. The document descriptions in the e-Guide are updated regularly – and the best way for us to do this is by incorporating the knowledge you share with us.

Variations

Help for documents

About the scan of this document <br> Markings on scan <br> Questions and answers about the document <br> More sample cards <br> Variants of the document